How Does Margin Trading Affect Reliance Industries Share Price?

Margin trading is a powerful tool in the stock market, allowing investors to borrow funds to increase their buying power and potentially amplify returns. However, it also introduces additional risk. For a large and influential company like Reliance Industries, margin trading can have significant effects on its Reliance Industries share Price.

Table of Contents

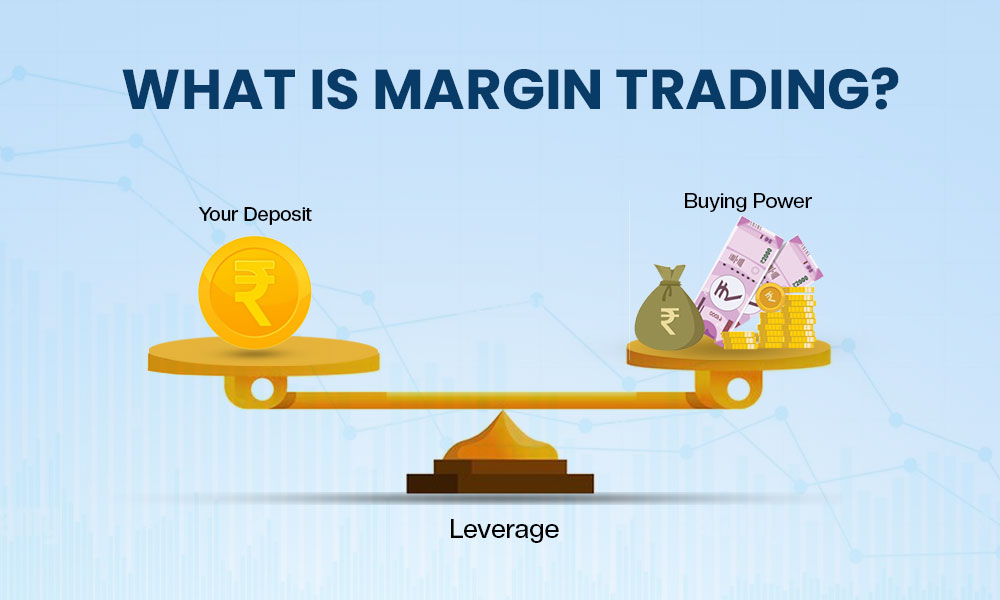

Understanding Margin Trading

Margin trading involves borrowing money from a broker to buy more shares than one could with just their own capital. Investors are required to put down a portion of the total investment as a margin, with the rest being loaned by the broker. This leverage can magnify both gains and losses, making it a double-edged sword.

The Impact on Reliance Industries’ Share Price

Reliance Industries, one of India’s largest conglomerates with interests spanning petrochemicals, refining, oil, telecommunications, and retail, is a significant player in the Indian stock market. The company’s share price can be influenced by various factors, including economic conditions, corporate performance, and investor sentiment. Margin trading adds another layer of complexity to this dynamic.

Increased Volatility

Margin trading can increase the volatility of Reliance Industries’ share price. When investors use margin to buy more shares, they effectively increase the demand for the stock. If the share price rises, these investors might experience significant gains, which could attract more buyers, driving the price even higher. Conversely, if the share price falls, margin traders might face losses that force them to sell their shares to cover their loans, exacerbating the decline. This heightened volatility can lead to sharper price swings, both upward and downward.

Amplified Market Reactions

Due to the leverage involved, margin traders are often more sensitive to market news and economic data. For a company like Reliance Industries, any significant news—be it about its quarterly earnings, changes in government policy, or fluctuations in commodity prices—can lead to amplified reactions in its share price. Positive news might prompt margin traders to increase their positions, driving the price up. Conversely, negative news can trigger a rush of selling as margin traders liquidate their positions to limit losses, potentially causing a sharp drop in the share price.

Influence of Market Sentiment

Margin trading can also affect market sentiment around Reliance Industries. If a large number of investors are using margin to buy the stock, it can create a sense of bullishness and encourage more buying, driving the share price higher. On the other hand, if margin traders start selling off their positions en masse, it can lead to a negative sentiment, impacting the stock price adversely. The perception of Reliance Industries’ stability and growth prospects can be swayed by these margin-driven market movements.

Impact of Margin Calls

A margin call occurs when the value of an investor’s account falls below the required margin level. If Reliance Industries’ share price declines significantly, margin traders might face margin calls from their brokers. To meet these calls, traders may need to sell their shares, potentially contributing to a further decline in the share price. This selling pressure can create a feedback loop, where falling prices lead to more margin calls and additional selling, further driving down the share price.

Liquidity Effects

Margin trading can impact the liquidity of Reliance Industries’ shares. Increased trading activity from margin traders can boost liquidity, making it easier to buy or sell shares without significantly impacting the price. However, if many margin traders decide to exit their positions simultaneously, it can lead to a liquidity crunch, making it harder to execute trades at desired prices and potentially exacerbating price movements.

Regulatory Considerations

Regulators often monitor MTF closely to ensure that it does not lead to excessive risk-taking and market instability. Measures such as setting margin requirements, monitoring trading volumes, and implementing circuit breakers can help mitigate some of the risks associated with margin trading and protect both investors and market integrity.

Conclusion

Margin trading can significantly impact Reliance Industries’ share price, introducing increased volatility, amplified market reactions, and potential liquidity issues. While it provides opportunities for investors to leverage their positions and potentially enhance returns, it also adds risks that can affect the stock’s stability and performance. Understanding these dynamics is crucial for investors looking to navigate the complexities of margin trading and its effects on major stocks like Reliance Industries.